Enabling credit scoring

for Institutions & SMEs

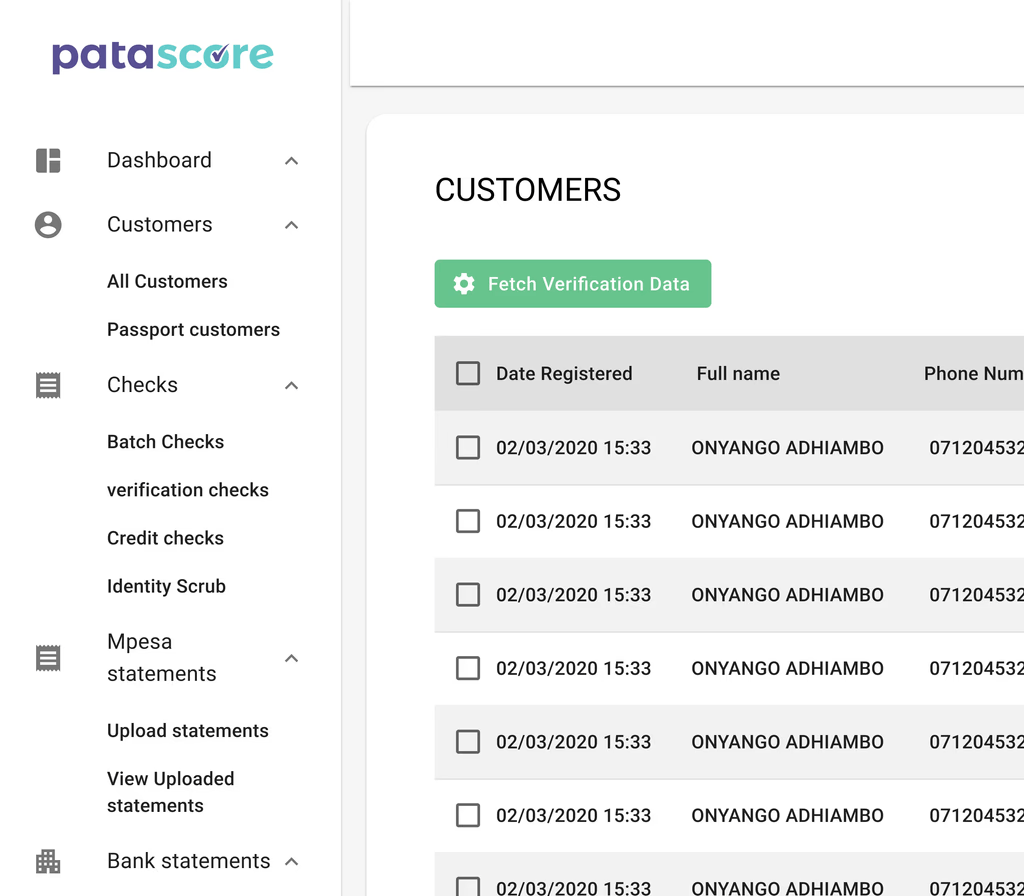

Our API-based, data-driven, secure centralized alternative credit scoring technology provides a holistic data aggregation infrastructure for accurate credit decisioning. You have an option to either use all or choose specific solutions for your institution needs.

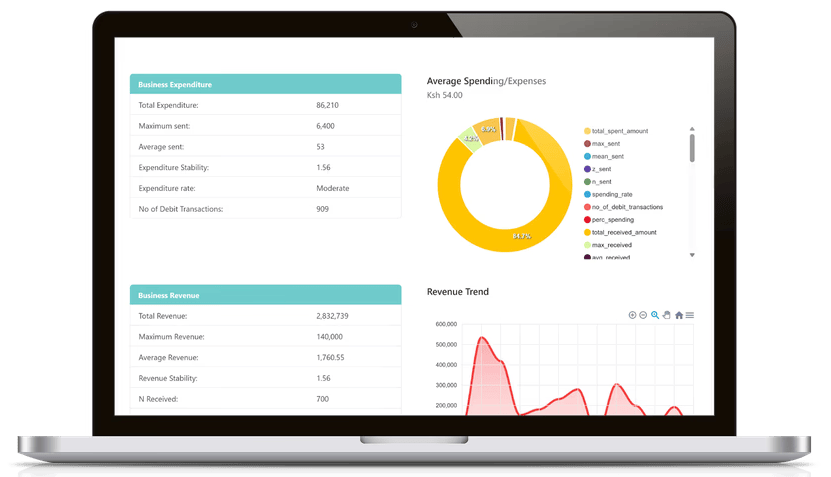

Mpesa, paybill and bank

statements analytics

We understand that analyzing financial statements could be hectic especially when you have a large pool of customers. Our solution allows you to bulk upload statements which are then analyzed with our AI powered system to give you analytics that are simple to understand.

Bulk upload of documents

Graphical Representation

Credit scoring the Financial statements.

Convert pdf statements to downloadable excel and CSV

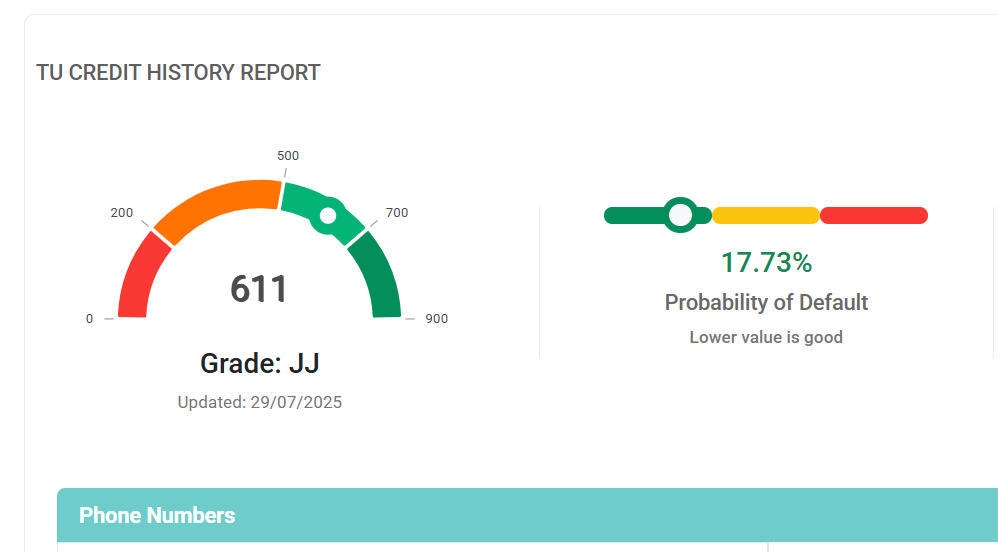

Credit History checks (CRB)

Through our aggregated pool of credit history from local Credit Bureaus, you’ll be able to identify key data which is calculated to give you a unique CRB score for the individual customer.Key data checked include:

loans taken

Betting history

Loan repayment rate

Performing and non-performing accounts

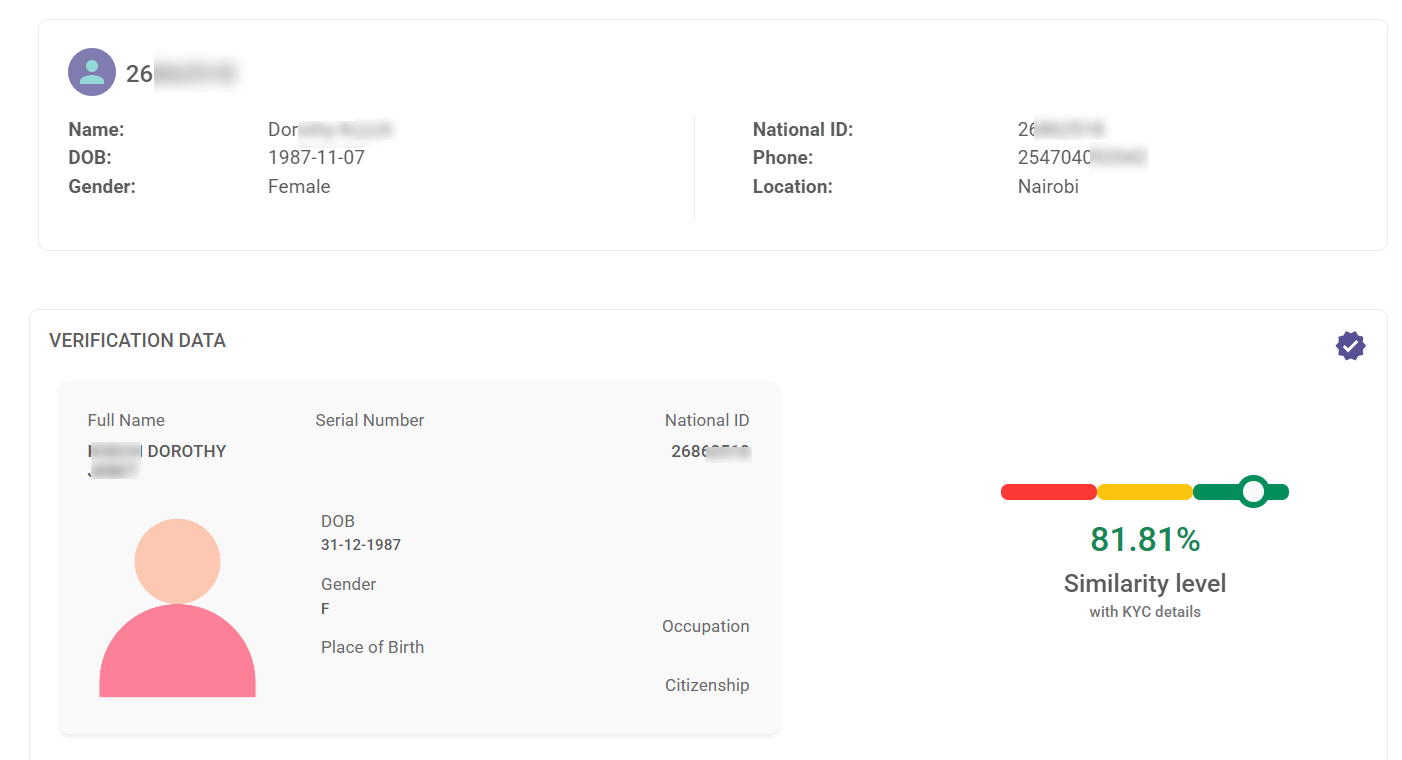

Identity checks (IPRS)

IPRS is the single source of truth for population of all Kenyan and foreign resident in Kenya. Here we check real time if customer names and ID information matches. Key data checked include:

Valid full names

Date of birth

Gender

Contact Information

Elimiza

Elimiza: Your Financial Education Partner for Business Growth. Empower your business with tips on how to access the right kind of credit and build long-term financial health.

Build your financial knowledge

Borrow Responsibly

Access higher credit limits

Strengthen your credit score

Expenditure Analysis

The Expenditure Analysis Feature helps individuals and businesses understand how their customers spend money by automatically categorising transactions from mobile money (e.g., M-Pesa) or bank statements.

- Essential vs. non-essential spending

- Monthly patterns and trends

- Cash inflows vs. outflows

- Top expense categories (e.g., rent, airtime, food)