Credit Scoring as a service

Get Credit Scores from transactional data

Instant Credit rating, recommended limit range and Fraud checks from the provided transactional data.

For Businesses

Built for lenders and businesses of all scales

Analyze Transactional data with ease—designed to help get credit score and financial behavior instantly.

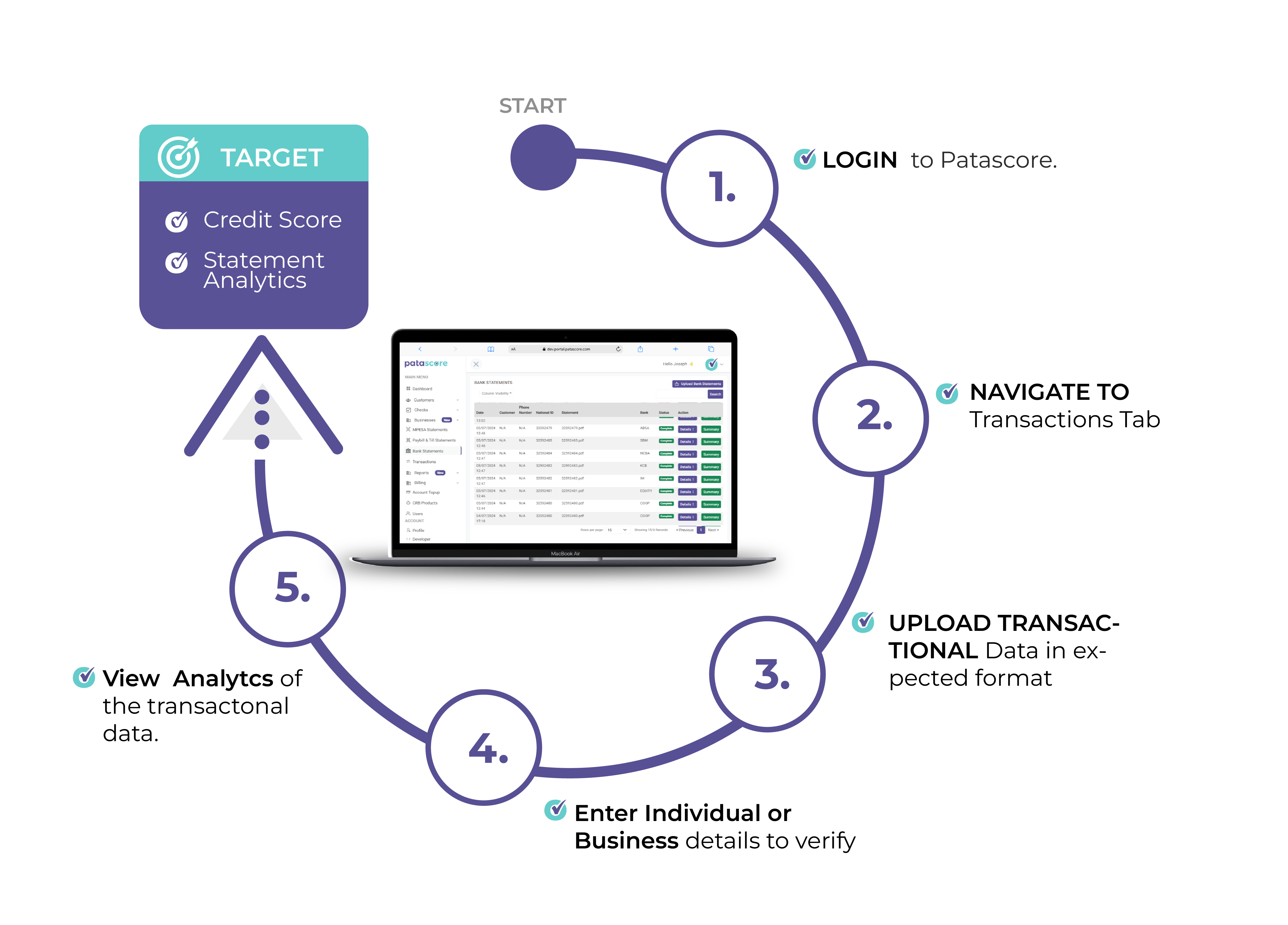

Step 1

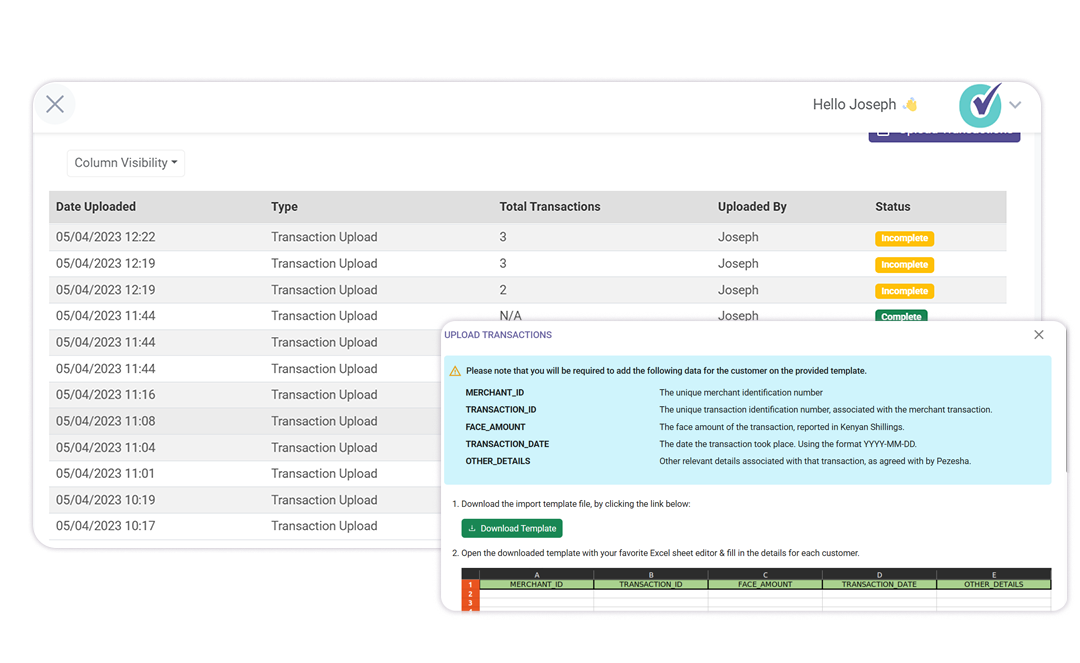

Transactional value-chain data easily uploaded via or portal or passed through API

Step 2

Transactional data is extracted and analyzed using proprietary extraction tool.

Step 3

Transactional data analyzed and credit rating and recommended limit range determined

Step 4

Fraud checks done on provided statements to ensure data authenticity.