AI driven Credit Scoring

Infrastructure powering

SME lending

We have scored more than 200,000+ users from wider data sets of more than 100 million transactions.

You do the business,

We'll handle the scoring.

Patascore enables one source of truth through providing various innovative solutions.

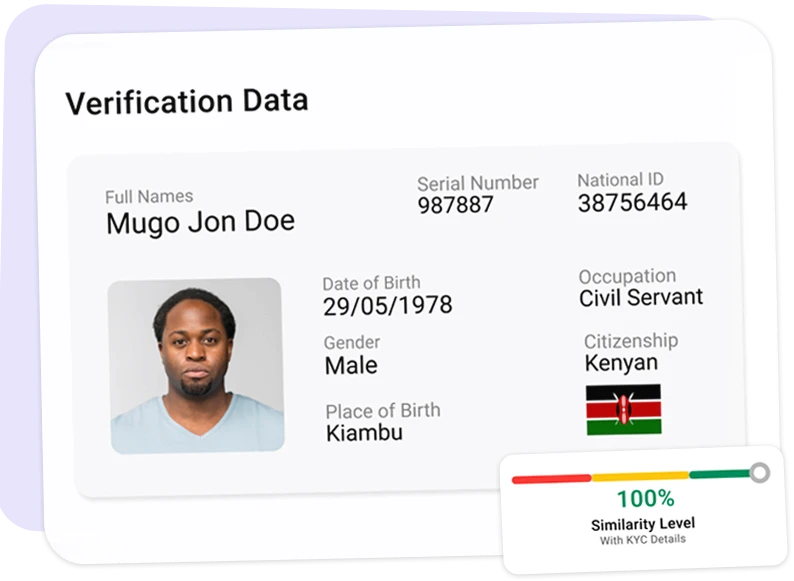

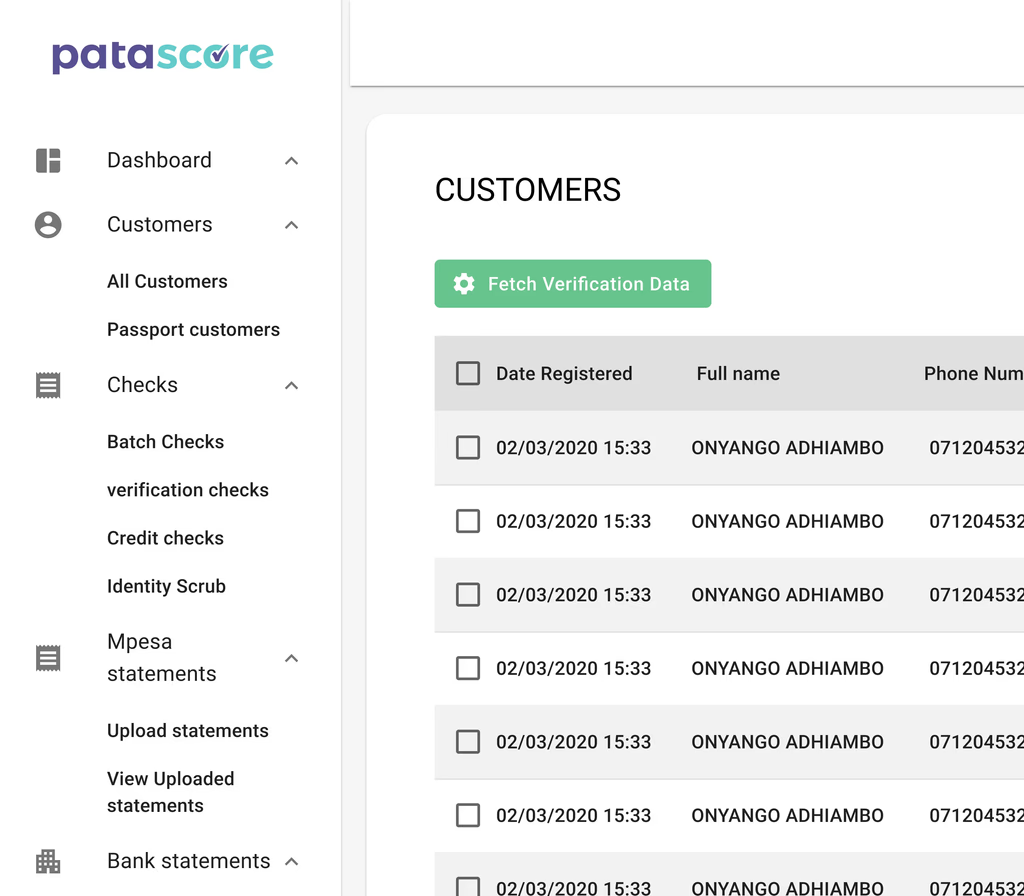

Identity Verification

Lender is able to verify the authenticity of provided identification details for an individual or business.

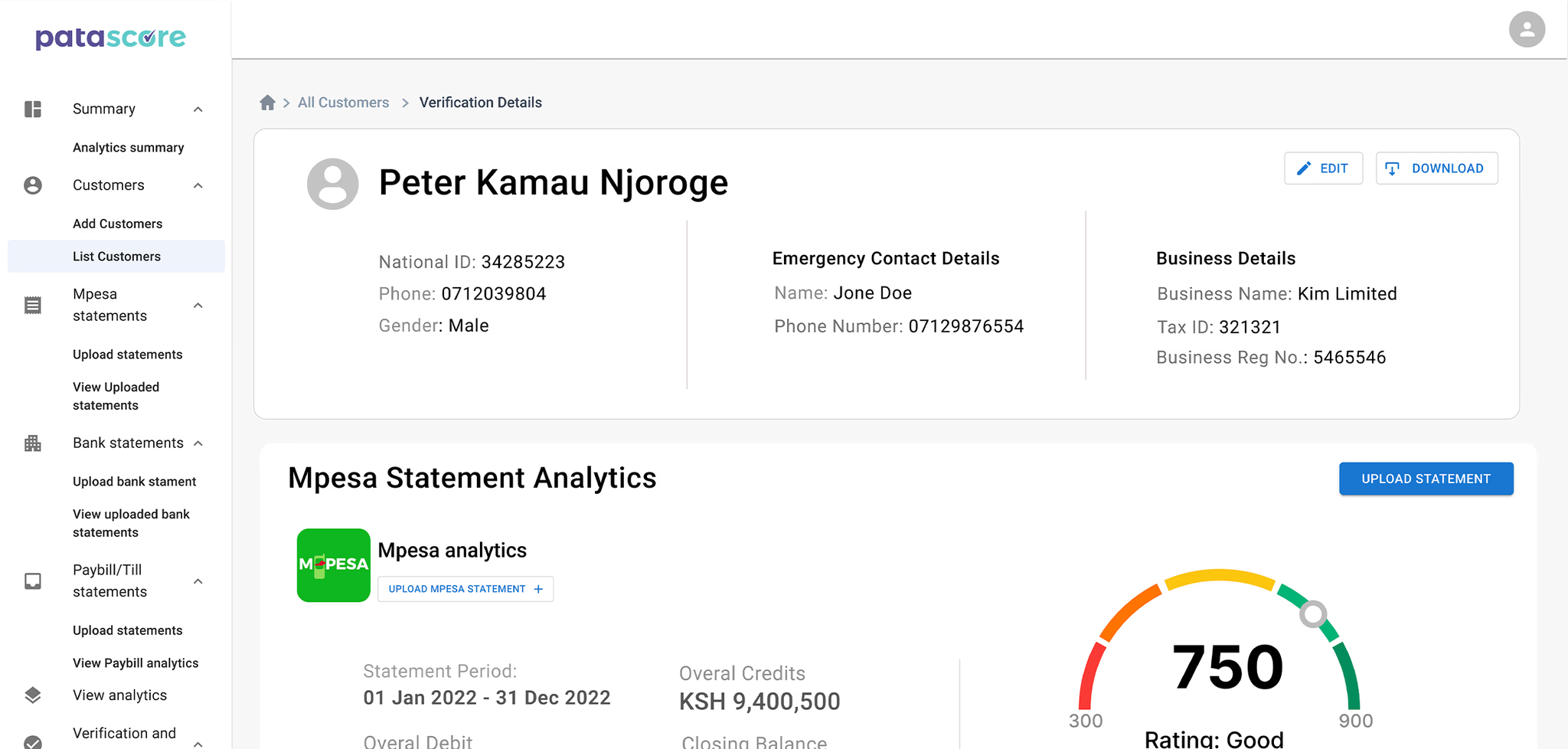

Financial statements analyser

Borrower mobile money and bank statements real time extraction and analytics.

Credit Scoring as a service

Analyze transactional data with ease—designed to help get credit score and financial behavior instantly.

Credit Report

Easily access your credit report—track your financial behavior, and take control of your financial future with confidence.

Elimiza

Access useful content to help an MSME to grow their business and understand how to use credit productively.

Our Results in Numbers

Discover the real impact Patascore has made. Patascore drives portfolio quality at scale.

60%

increase in disbursed loans.

Our AI-driven credit scoring models have processed over 5 million loan applications, reducing manual intervention by 80% and cutting turnaround time to under 30 minutes.

400,000 +

MSMEs Funded

We’ve enabled 400,000 MSMEs without traditional credit histories to access financing while ensuring transparent decision-making.

20%

of applications flagged as suspicious

Our AI driven models have flagged 20% of applications as suspicious, preventing more than 200,000 cases of potential fraud.

20%

Improved loan approval rates

Our AI models have improved loan approval rates by 20% while maintaining a 5% default rate.

How it works ?

Patascore, our proprietary AI driven credit scoring technology offers 85% predictive accuracy

Inputs

- Transactional Data

- Bank and Mobile money statements

- Credit Bureau Data

Patascore AI Driven Engine

- Gen AI statement Extraction Module

- Configurable Business Rules

- AI Fraud Detection

Output

- AI Credit report for MSMEs

- Credit Scores and Loan Limits

- Fraud Results and rejection Reasons

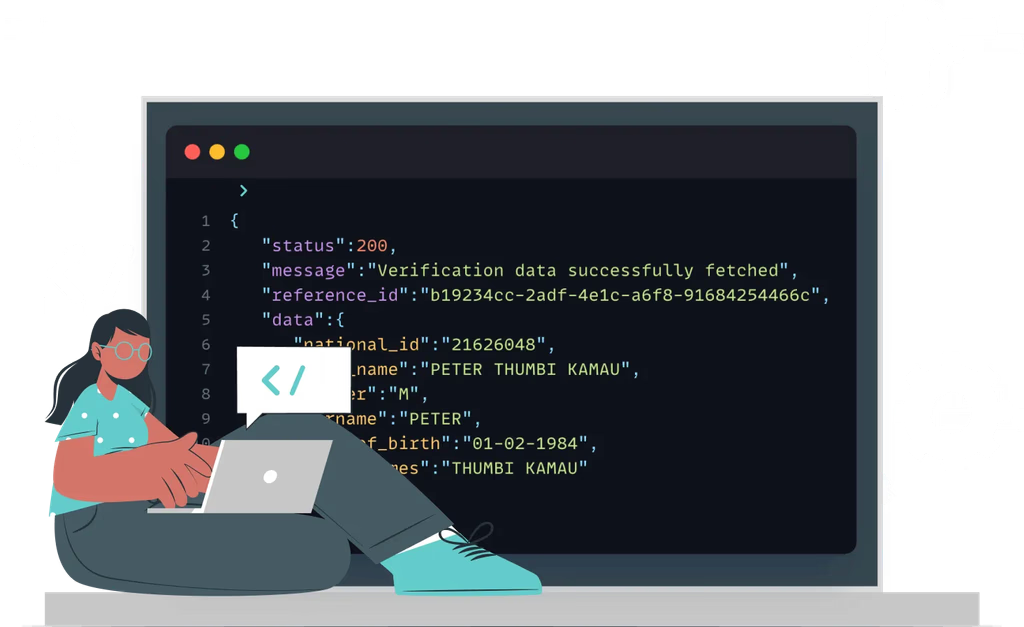

Access our scoring APIs

With our API first approach, you can easily connect your infrastructure with our scoring solutions.

Two ways you can access our solution

We've made it easy for you to experience the power of contextual credit scoring:

Common Questions & Answers

Here’s everything you need to know about Patascore, from features to getting started.

Got any specific questions?

Contact UsSubscribe to Newsletter

Subscribe today to receive personalized financial tips, news, and updates delivered directly to your email.

Never Miss our exciting updates — Subscribe Now!