Secure & Scalable API driven Credit decisioning & KYC infrastructure.

Access our infrastructure to quickly score your pool of customers

LoginBook a demo

Two ways you can access our solution

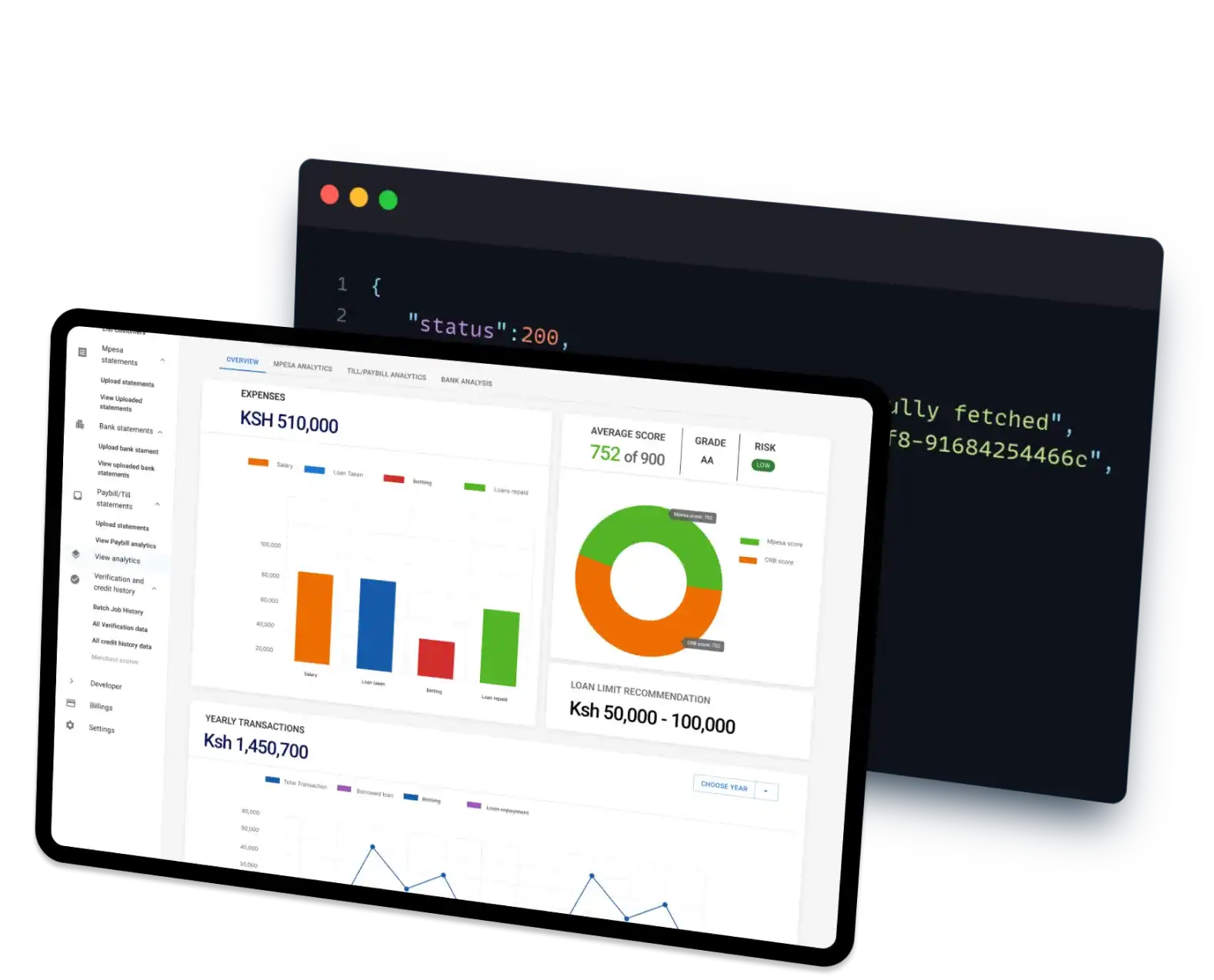

Patascore Portal

- No setup needed, click and play

- Upload multiple customers statements

- In depth analytics

- Do credit and verification checks

Patascore API

- Flexible customization.

- connect our API with your current. infrastracture with our Patascore guide doc.

- Support from Pezesha team.

FEATURES

Unified and centralised

data platform

streamline your KYC processes by having a holistic view of a customers uniform KYC data at all times improving your loan origination process while reducing identity fraud cases and approval time.

Credit decisioning tool

Plug and Play your business/credit rules and seamlessly integrate with your existing systems. Single system of record for variables, models and policies. Real time evaluation and comparison of models/strategies.

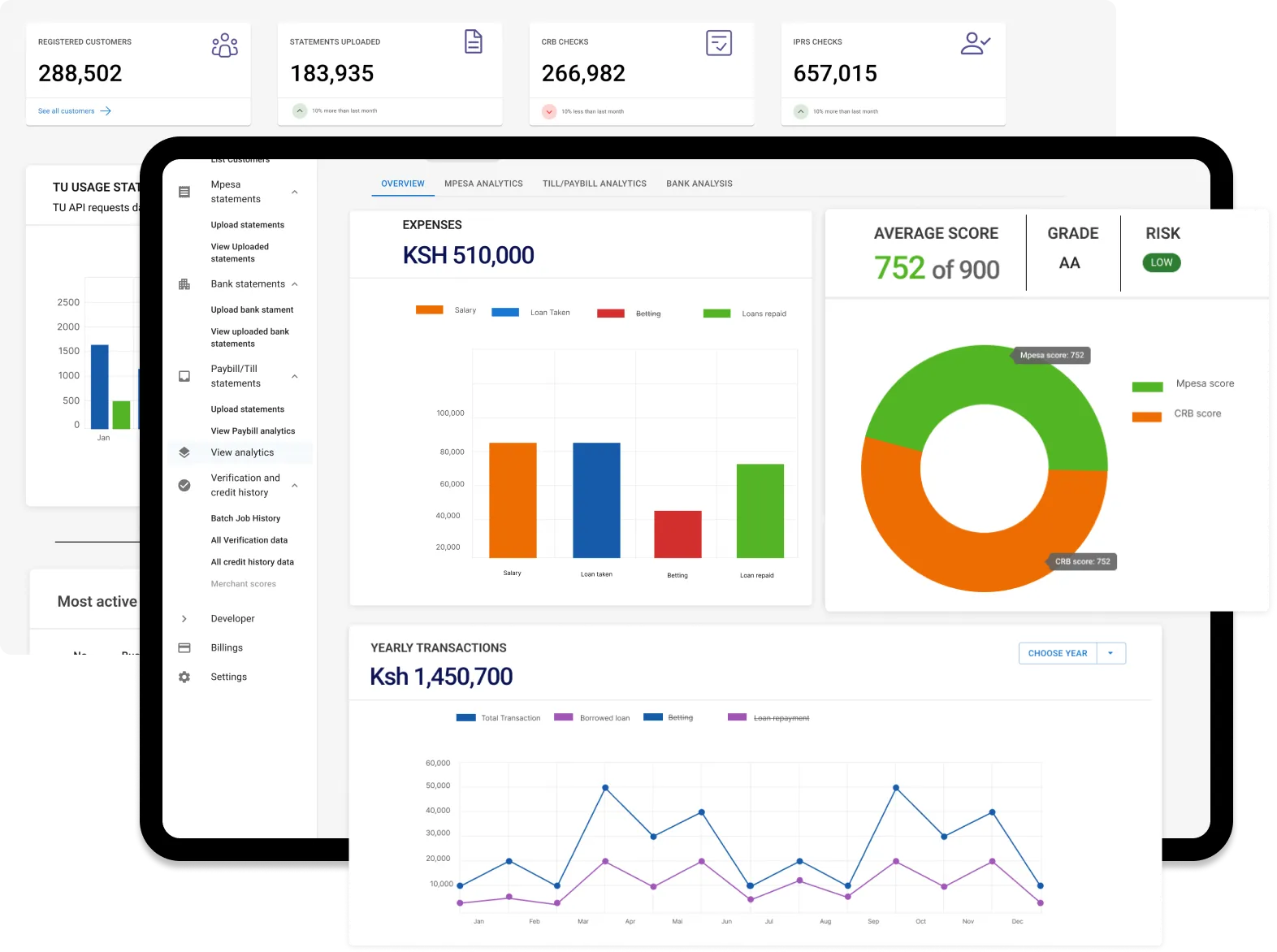

Data analytics

We help you make informed and robust credit decisioning from a wider data pool and generate useful insights to better understand and predict a customer’s behaviour.

Reduced default rates

Having unified KYC and financial education means more quality users leading to reduced fraud and more returns in your lending activities.

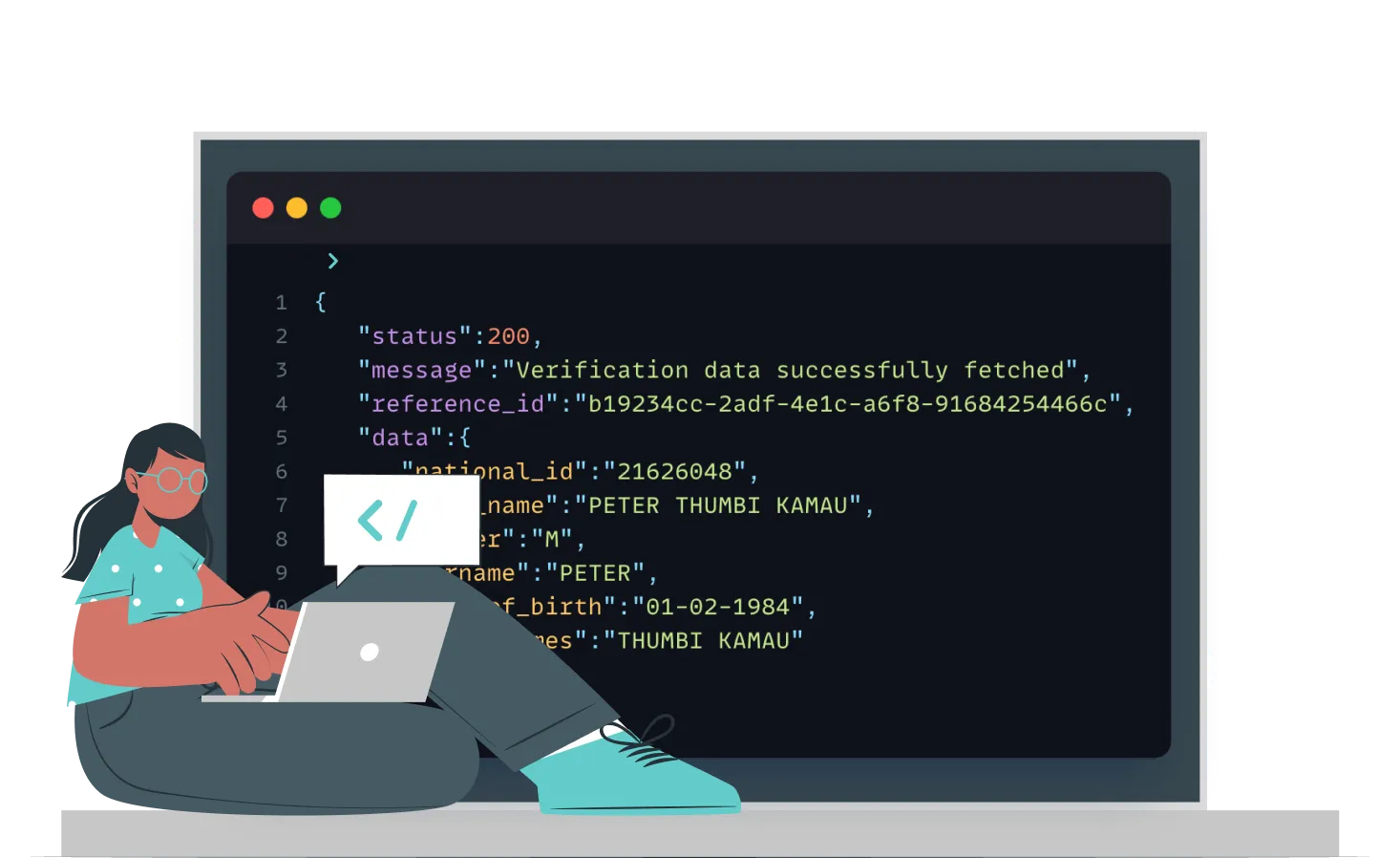

Easy to integrate with our APIs

We have built well designed and documented secure APIs to allow you to integrate easily with existing loan management or credit scoring systems you are using internally.

Need us to set you up?

Reach us through the form below and a member of the Pezesha team will follow-up soon to get you started.